Learning how to make money on the internet and what programs work for each of us.News that is important for all of us and family issues..RANDOM THOUGHTS AND LAUGHS!

loading ...

Monday, February 25, 2008

Thursday, February 21, 2008

ACA misleading the public about financing options....

Ok where does the below information state you have ot have a credit score of 500 or higher in order for them to even think about financing you for a car???

False Advertising is very clear here and misleading the public..

If you've been looking for a great rate on a car loan for a used car in Sacramento, you've come to the right place! Here at ACA Cars of Sacramento we work with multiple lenders across the state to ensure that you get the best rate possible on a car loan. Even if you have bad or no credit, ACA Cars of Sacramento will work with you to ensure that you get the rate that fits perfectly with your budget.

Check out our finance calculator! It can show you an estimated monthly payment based on your annual percentage rate, down payment, vehicle trade in value, and the purchase price of your new car, truck or SUV. With the click of a mouse, we can also pull cars from our database that will match your budget perfectly. Visit us today and get a car loan in Sacramento!

Contact our financial experts to have a financial plan custom-made to fit your needs.

False Advertising is very clear here and misleading the public..

If you've been looking for a great rate on a car loan for a used car in Sacramento, you've come to the right place! Here at ACA Cars of Sacramento we work with multiple lenders across the state to ensure that you get the best rate possible on a car loan. Even if you have bad or no credit, ACA Cars of Sacramento will work with you to ensure that you get the rate that fits perfectly with your budget.

Check out our finance calculator! It can show you an estimated monthly payment based on your annual percentage rate, down payment, vehicle trade in value, and the purchase price of your new car, truck or SUV. With the click of a mouse, we can also pull cars from our database that will match your budget perfectly. Visit us today and get a car loan in Sacramento!

Contact our financial experts to have a financial plan custom-made to fit your needs.

Labels:

cars,

false advertising,

financing,

loans,

misleading,

options

Widgets from Blogrush

Blogrush is a good way to get others to see your blog. I have had it since the launch and it has helped me get views and customers for my products.

Please try it and see how well it works for you!

Please try it and see how well it works for you!

Saturday, February 16, 2008

still paying since 2003

2/16/2008 waterkitty 1.94 Commissions Payment

2/16/2008 fanfuzd 4.45 Commissions Payment

1/26/2008 cherry 1.30 Commissions Payment

1/17/2008 horse518 1.79 Commissions Payment

1/7/2008 egoldpig 5.51 Commissions Payment

1/2/2008 pepper2 2.19 Commissions Payment

12/11/2007 nhtpscd 5.54 Commissions Payment

12/9/2007 dewey 3.84 Commissions Payment

2/16/2008 fanfuzd 4.45 Commissions Payment

1/26/2008 cherry 1.30 Commissions Payment

1/17/2008 horse518 1.79 Commissions Payment

1/7/2008 egoldpig 5.51 Commissions Payment

1/2/2008 pepper2 2.19 Commissions Payment

12/11/2007 nhtpscd 5.54 Commissions Payment

12/9/2007 dewey 3.84 Commissions Payment

Friday, February 15, 2008

PAid by Hits4pay!

Dear WEWEARIT,

Multiple Stream Marketing just sent you money with PayPal.

Multiple Stream Marketing is a Verified buyer.

--------------------------------------------------------------------------------

Payment Details

Amount: $26.83 USD

Transaction ID: 8FE23886GC121293C

Subject: AFFILIATE COMMISSION FOR HITS4PAY.COM

Note: --------------------------------------

AFFILIATE COMMISSION FOR HITS4PAY.COM

Multiple Stream Marketing just sent you money with PayPal.

Multiple Stream Marketing is a Verified buyer.

--------------------------------------------------------------------------------

Payment Details

Amount: $26.83 USD

Transaction ID: 8FE23886GC121293C

Subject: AFFILIATE COMMISSION FOR HITS4PAY.COM

Note: --------------------------------------

AFFILIATE COMMISSION FOR HITS4PAY.COM

Thursday, February 14, 2008

Last day to get tshirt is 02/16/08

Ok Folks!

I have done my best to help out wit hthe things I have been doing for Zachary's Family and now it is time for me to end the sale of the tshirts and tally up the total and send the money to the family.

So 02/16/08 at MIDNIGHT will be the last day to order a tshirt if you planned on doing so.

it will take me 2 weeks to get the final paper work on the total sale and the 2.00 from each shirt will be given to Zachery's mom.

so far I only have 10 sales............so that is only 20.00...

It is alteast something to go towards any bills that may come in..

Thanks in advance for the orders!

You know everyone else can help also:::

host a car wash and have donations collected for the family

BAke sale

there are plenty that all of his friends can do to help the family.

We also need to keep looking for the driver of that WHITE CAR and make sure they are held accountable for their actions on that day also.

I have done my best to help out wit hthe things I have been doing for Zachary's Family and now it is time for me to end the sale of the tshirts and tally up the total and send the money to the family.

So 02/16/08 at MIDNIGHT will be the last day to order a tshirt if you planned on doing so.

it will take me 2 weeks to get the final paper work on the total sale and the 2.00 from each shirt will be given to Zachery's mom.

so far I only have 10 sales............so that is only 20.00...

It is alteast something to go towards any bills that may come in..

Thanks in advance for the orders!

You know everyone else can help also:::

host a car wash and have donations collected for the family

BAke sale

there are plenty that all of his friends can do to help the family.

We also need to keep looking for the driver of that WHITE CAR and make sure they are held accountable for their actions on that day also.

Wednesday, February 13, 2008

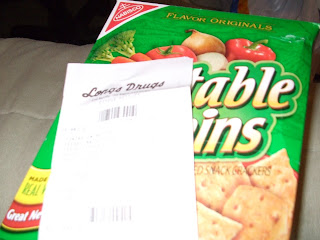

Longs Drugs Has expired product on their shelf again

Ok folks remember I posted about LONGS DRUG having old outdated food on their shelf???

well it has happened again todays date is 02/13/08 aand I purchased a box of veggie crackers and opened it and tasted it and was like dang these taste odd so I looked at the date on the box and it was 21NOV07...... OMG................

The 1 800 number I called about it last time could of really have cared less and here we go again.... I will call it once again and this time the health board.

here are the pictures.. good thing I have a camera..lol

Monday, February 11, 2008

Wednesday, February 06, 2008

Legal News..from FairMeasures!

Legal News

Company Wins Case With Good Investigation & Training

- By Rita Risser, California attorney at law

No matter how good your anti-harassment policy and practice, harassment happens. But if your company responds to complaints with a good investigation and training, according to a new case you will not have to pay punitive damages.

DeVilbiss Company had a zero tolerance sexual harassment policy. A male accountant complained about sexual horseplay from his female supervisor. The company conducted four separate investigations of his complaint, but none revealed evidence that would have justified firing the supervisor. In the interviews, coworkers were asked neutral questions which were open ended and not suggestive, for example, "Have you seen any inappropriate behavior in the department?"

The company instituted a harassment prevention training program and required all employees, including the supervisor and the accountant, to attend.

The company also hired outside employment law specialists to look into whether its internal investigations had been proper and thorough and contracted with them to investigate the accountant's claims further. The outside specialists determined that the company's investigations had been thorough and confirmed the company's conclusions.

The accountant argued it was unreasonable for his boss to remain as his supervisor. The company responded that the small size of the plant and of the accounting department made it impossible to accommodate his request for another supervisor unless the supervisor was terminated. Terminating her without more evidence would have exposed the company to legal action by her. Moreover, there were no further complaints by the accountant of any sexual harassment after the company took its actions in response to his initial complaint.

The court upheld the actions of the company and denied punitive damages.

What this means to you: Whenever there is a complaint of harassment, make sure your company does everything right. It could save you some big money!

Dominic v. DeVilbiss Air Power Co., (8th Cir. 2007)

The best harassment prevention training we know of is ... ours! Check it out.

Big Money

Ford Motor Co. and others agreed to pay $1.6 million to settle a race discrimination class action case arising from an apprenticeship test that adversely impacted African Americans.

A Hawaii man won $2.5 million in a race discrimination settlement against Lockheed Martin.

Fair Measures reports only settlements and final judgments - never jury verdicts.

How much does training cost? A lot less than a lawsuit! Email us to find out how our training can help your company.

Ask the Lawyers #1

We laid off an employee who now says he's disabled - should we worry?

We have an employee who we have just had to let go due to lack of work. This employee is now saying they are going to sue the company under the ADA guidelines. We did not know of any mental condition nor was this employee let go for such said reason. Does the company need to worry about this threat?

Rita Risser replies:

I wouldn't worry, exactly, but now would be a good time to make sure all of your documentation is in order. Get witness statements from everyone as to why s/he was picked for layoff versus someone else, and declaring they had never received any notice of a mental condition. If the employee files with the EEOC, then hire a local attorney. Also, if the employee files for unemployment and states on the form that s/he they believes it was due to discrimination, you need to set the record straight. You do not oppose the unemployment, but document the correct reason.

Good luck.

How to handle layoffs with "risky" employees is covered in our Managing Within the Law II program.

Ask the Lawyers #2

We owe employee and employee owes us - can we hold check until he pays us back?

I am an HR representative for a hotel chain. Some accounting problems show that we owe an employee money (payroll). The employee is salaried and we owed money from past payroll checks, however, by a physical count of what we call a 'bank' the employee owes us money.

The company put a stop payment on the check (not my idea) and reissued another check. They are holding the check in lieu of the employee paying the amount owed in their "bank." Is this allowed? I think not but can't find any legal precedence to support. Thank you for your help in this matter.

Rita Risser replies:

It depends on state law and you should talk to a local attorney. But in California and many other states, you have to pay employees for working and if they owe you money, they can then pay you back -- you cannot deduct what they owe. If they don't pay, you could take them to small claims court.

Every manager needs to know the basics of employment law. Check out our Managing within the Law.

Ask the Lawyers #3

Can managers pay above the salary range?

Is it legal for managers to pay certain staff whatever they choose to even though we have salary ranges and performance targets? We have some staff who are paid well beyond their "worth" and others that are paid well below market value?

Rita Risser replies:

Legally, you can pay people whatever you want, as long as you don't discriminate on the basis of sex, race, age, etc. If the managers are inconsistent in their own pay practices, and there are differences of gender or national origin among employees, then it may at least appear to be illegal unless the discrepancies are justified by legitimate business reasons. If, on the other hand, each manager is consistent but you have inconsistencies across the organization, that is safer legally. However, sometimes the problem is that random behavior by managers might look like a discriminatory pattern if seen across the organization. That's why most companies have salary grades and try to have consistency among employees.

Good luck.

The only thing worse than an untrained manager is an untrained manager who treats employees inconsistently for no good reason. Call us to help you. 1-800-458-2778.

Go here for an archive of eNews questions and articles.

We encourage you to pass this announcement on to your colleagues and friends, as long as the following credit line is used: © Copyright 2008, Fair Measures Inc., http://www.FairMeasures.com

Disclaimer: This information is provided with the understanding that the author and publisher are not engaged in rendering legal or other professional services. The publishers disclaim any liability, loss or risk incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this information. This information is not a substitute for the advice of a competent legal or other professional person.

Company Wins Case With Good Investigation & Training

- By Rita Risser, California attorney at law

No matter how good your anti-harassment policy and practice, harassment happens. But if your company responds to complaints with a good investigation and training, according to a new case you will not have to pay punitive damages.

DeVilbiss Company had a zero tolerance sexual harassment policy. A male accountant complained about sexual horseplay from his female supervisor. The company conducted four separate investigations of his complaint, but none revealed evidence that would have justified firing the supervisor. In the interviews, coworkers were asked neutral questions which were open ended and not suggestive, for example, "Have you seen any inappropriate behavior in the department?"

The company instituted a harassment prevention training program and required all employees, including the supervisor and the accountant, to attend.

The company also hired outside employment law specialists to look into whether its internal investigations had been proper and thorough and contracted with them to investigate the accountant's claims further. The outside specialists determined that the company's investigations had been thorough and confirmed the company's conclusions.

The accountant argued it was unreasonable for his boss to remain as his supervisor. The company responded that the small size of the plant and of the accounting department made it impossible to accommodate his request for another supervisor unless the supervisor was terminated. Terminating her without more evidence would have exposed the company to legal action by her. Moreover, there were no further complaints by the accountant of any sexual harassment after the company took its actions in response to his initial complaint.

The court upheld the actions of the company and denied punitive damages.

What this means to you: Whenever there is a complaint of harassment, make sure your company does everything right. It could save you some big money!

Dominic v. DeVilbiss Air Power Co., (8th Cir. 2007)

The best harassment prevention training we know of is ... ours! Check it out.

Big Money

Ford Motor Co. and others agreed to pay $1.6 million to settle a race discrimination class action case arising from an apprenticeship test that adversely impacted African Americans.

A Hawaii man won $2.5 million in a race discrimination settlement against Lockheed Martin.

Fair Measures reports only settlements and final judgments - never jury verdicts.

How much does training cost? A lot less than a lawsuit! Email us to find out how our training can help your company.

Ask the Lawyers #1

We laid off an employee who now says he's disabled - should we worry?

We have an employee who we have just had to let go due to lack of work. This employee is now saying they are going to sue the company under the ADA guidelines. We did not know of any mental condition nor was this employee let go for such said reason. Does the company need to worry about this threat?

Rita Risser replies:

I wouldn't worry, exactly, but now would be a good time to make sure all of your documentation is in order. Get witness statements from everyone as to why s/he was picked for layoff versus someone else, and declaring they had never received any notice of a mental condition. If the employee files with the EEOC, then hire a local attorney. Also, if the employee files for unemployment and states on the form that s/he they believes it was due to discrimination, you need to set the record straight. You do not oppose the unemployment, but document the correct reason.

Good luck.

How to handle layoffs with "risky" employees is covered in our Managing Within the Law II program.

Ask the Lawyers #2

We owe employee and employee owes us - can we hold check until he pays us back?

I am an HR representative for a hotel chain. Some accounting problems show that we owe an employee money (payroll). The employee is salaried and we owed money from past payroll checks, however, by a physical count of what we call a 'bank' the employee owes us money.

The company put a stop payment on the check (not my idea) and reissued another check. They are holding the check in lieu of the employee paying the amount owed in their "bank." Is this allowed? I think not but can't find any legal precedence to support. Thank you for your help in this matter.

Rita Risser replies:

It depends on state law and you should talk to a local attorney. But in California and many other states, you have to pay employees for working and if they owe you money, they can then pay you back -- you cannot deduct what they owe. If they don't pay, you could take them to small claims court.

Every manager needs to know the basics of employment law. Check out our Managing within the Law.

Ask the Lawyers #3

Can managers pay above the salary range?

Is it legal for managers to pay certain staff whatever they choose to even though we have salary ranges and performance targets? We have some staff who are paid well beyond their "worth" and others that are paid well below market value?

Rita Risser replies:

Legally, you can pay people whatever you want, as long as you don't discriminate on the basis of sex, race, age, etc. If the managers are inconsistent in their own pay practices, and there are differences of gender or national origin among employees, then it may at least appear to be illegal unless the discrepancies are justified by legitimate business reasons. If, on the other hand, each manager is consistent but you have inconsistencies across the organization, that is safer legally. However, sometimes the problem is that random behavior by managers might look like a discriminatory pattern if seen across the organization. That's why most companies have salary grades and try to have consistency among employees.

Good luck.

The only thing worse than an untrained manager is an untrained manager who treats employees inconsistently for no good reason. Call us to help you. 1-800-458-2778.

Go here for an archive of eNews questions and articles.

We encourage you to pass this announcement on to your colleagues and friends, as long as the following credit line is used: © Copyright 2008, Fair Measures Inc., http://www.FairMeasures.com

Disclaimer: This information is provided with the understanding that the author and publisher are not engaged in rendering legal or other professional services. The publishers disclaim any liability, loss or risk incurred as a consequence, directly or indirectly, of the use and application of any of the contents of this information. This information is not a substitute for the advice of a competent legal or other professional person.

Tuesday, February 05, 2008

Gathering for Zach went well

Well the day came to have our moment of silence for our friend Zachary Curtice, we went and we found out a few things that I think will ease his families mind and his true close friends.

Zac had someone holding his hand and saying a prayer for him and he did not leave this earth all alone, that person was the Manager of Ethan Allan, one of her staff members who watched and screamed out and she ran out the door to try and help,even tho, there was no help to be given she could only hold his hand and pray... I told her that I would make sure everyone knew that.

She said that He was special to people that did not even know him, that is true and he was very special to all of us that did know him.

For those of you that did not make it to the gathering I hope you can take time to stop by and take a moment..

If a total stranger can help our friend the least anyone of us could do is stop by and say a prayer where he died at.

Monday, February 04, 2008

Moment of Silence for Zachary Curtice

On feb 5th 2008 at 5PM we will be gathering near the accident scene and saying our goodbyes to ZACH aka Zacman.

Everyone is invited to share this time with his friends.

Flowers and candles are more then welcome for everyone to bring.

Madison and near Auburn (across from Ethan Allen)

Everyone is invited to share this time with his friends.

Flowers and candles are more then welcome for everyone to bring.

Madison and near Auburn (across from Ethan Allen)

Sunday, February 03, 2008

READ..NEW CREDIT CARD SCAM

Credit Card Scam

I received this and wanted to page this along to our general

membership.

http://www.Snopes.com

says this is true. See this site -

http://www.snopes.com/crime/warnings/creditcard.asp

This one is pretty slick since they provide YOU with all the

information, except the one piece they want.

Note, the callers do not ask for your card number; they already have

it. This information is worth reading. By understanding how the VISA &

MasterCard Telephone Credit Card Scam works, you'll be better prepared

to protect yourself.

One of our employees was called on Wednesday from "VISA", and I was

called on Thursday from "Master Card".

The scam works like this: Person calling says, "This is (name), and I'm

calling from the Security and Fraud Department at VISA. My badge

number is 12460. Your card has been flagged for an unusual purchase

pattern, and I'm calling to verify. This would be on your VISA card which

was issued by ( name of bank). Did you purchase an Anti-Telemarketing

Device for $497.99 from a Marketing company based in Arizona ?" When you

say "No", the caller continues with, "Then we will be issuing a credit

to your account. This is a company we have been watching and the

charges range from $297 to $497, just under the $500 purchase pattern that

flags most cards. Before your next statement, the credit will be sent

to (gives you your address), is that correct?"

You say "yes". The caller continues - "I will be starting a Fraud

investigation. If you have any questions, you should call

the 1- 800 number listed on the back of your card (1-800-VISA) and ask

for Security.

You will need to refer to this Control Number. The caller then gives

you a 6 digit number. "Do you need me to read it again?"

Here's the IMPORTANT part on how the scam works –

The caller then says, "I need to verify you are in possession of your

card."

He'll ask you to "turn your card over and look for some numbers."

There are 7 numbers; the first 4 are part of your card number, the next 3

are the security Numbers' that verify you are the possessor of the card.

These are the numbers you sometimes use to make Internet purchases to

prove you have the card. The caller will ask you to read the 3

numbers to him. After you tell the caller the 3 numbers, he'll say, "That is

correct, I just needed to verify that the card has not been lost or

stolen, and that you still have your card. Do you have any other

questions?" After you say, "No," the caller then thanks you and states,

"Don't hesitate to call back if you do", and hangs up.

You actually say very little, and they never ask for or tell you the

Card number. But after we were called on Wednesday, we called back

within 20 minutes to ask a question. Are we glad we did! The REAL VISA

security Department told us it was a scam and in the last 15 minutes a new

purchase of $49799 was charged to our card

Long story - short - we made a real fraud report and closed the VISA

account.. VISA is reissuing us a new number. What the scammers want is

the 3-digit PIN number on the back of the card Don't give it to them.

Instead, tell them you'll call VISA or Master card directly for

verification of their conversation.

The real VISA told us that they will never ask for anything on the card

as they already know the information since they issued the card! If

you give the scammers your 3 Digit PIN Number, you think you're

receiving a credit. However, by the time you get your statement you'll see

charges for purchases you didn't make, and by then it's almost too late

and/or more difficult to actually file a fraud report.

What makes this more remarkable is that on Thursday, I got a call from

a "Jason Richardson of Master Card" with a word-for-word repeat of the

VISA scam. This time I didn't let him finish. I hung up! We filed a

police report, as instructed by VISA. The police said they are taking

several of these reports daily! They also urged us to tell everybody

we know that this scam is happening

Please pass this on to all your family and friends. By informing each

other, we protect each other.

I received this and wanted to page this along to our general

membership.

http://www.Snopes.com

says this is true. See this site -

http://www.snopes.com/crime/warnings/creditcard.asp

This one is pretty slick since they provide YOU with all the

information, except the one piece they want.

Note, the callers do not ask for your card number; they already have

it. This information is worth reading. By understanding how the VISA &

MasterCard Telephone Credit Card Scam works, you'll be better prepared

to protect yourself.

One of our employees was called on Wednesday from "VISA", and I was

called on Thursday from "Master Card".

The scam works like this: Person calling says, "This is (name), and I'm

calling from the Security and Fraud Department at VISA. My badge

number is 12460. Your card has been flagged for an unusual purchase

pattern, and I'm calling to verify. This would be on your VISA card which

was issued by ( name of bank). Did you purchase an Anti-Telemarketing

Device for $497.99 from a Marketing company based in Arizona ?" When you

say "No", the caller continues with, "Then we will be issuing a credit

to your account. This is a company we have been watching and the

charges range from $297 to $497, just under the $500 purchase pattern that

flags most cards. Before your next statement, the credit will be sent

to (gives you your address), is that correct?"

You say "yes". The caller continues - "I will be starting a Fraud

investigation. If you have any questions, you should call

the 1- 800 number listed on the back of your card (1-800-VISA) and ask

for Security.

You will need to refer to this Control Number. The caller then gives

you a 6 digit number. "Do you need me to read it again?"

Here's the IMPORTANT part on how the scam works –

The caller then says, "I need to verify you are in possession of your

card."

He'll ask you to "turn your card over and look for some numbers."

There are 7 numbers; the first 4 are part of your card number, the next 3

are the security Numbers' that verify you are the possessor of the card.

These are the numbers you sometimes use to make Internet purchases to

prove you have the card. The caller will ask you to read the 3

numbers to him. After you tell the caller the 3 numbers, he'll say, "That is

correct, I just needed to verify that the card has not been lost or

stolen, and that you still have your card. Do you have any other

questions?" After you say, "No," the caller then thanks you and states,

"Don't hesitate to call back if you do", and hangs up.

You actually say very little, and they never ask for or tell you the

Card number. But after we were called on Wednesday, we called back

within 20 minutes to ask a question. Are we glad we did! The REAL VISA

security Department told us it was a scam and in the last 15 minutes a new

purchase of $49799 was charged to our card

Long story - short - we made a real fraud report and closed the VISA

account.. VISA is reissuing us a new number. What the scammers want is

the 3-digit PIN number on the back of the card Don't give it to them.

Instead, tell them you'll call VISA or Master card directly for

verification of their conversation.

The real VISA told us that they will never ask for anything on the card

as they already know the information since they issued the card! If

you give the scammers your 3 Digit PIN Number, you think you're

receiving a credit. However, by the time you get your statement you'll see

charges for purchases you didn't make, and by then it's almost too late

and/or more difficult to actually file a fraud report.

What makes this more remarkable is that on Thursday, I got a call from

a "Jason Richardson of Master Card" with a word-for-word repeat of the

VISA scam. This time I didn't let him finish. I hung up! We filed a

police report, as instructed by VISA. The police said they are taking

several of these reports daily! They also urged us to tell everybody

we know that this scam is happening

Please pass this on to all your family and friends. By informing each

other, we protect each other.

Subscribe to:

Comments (Atom)